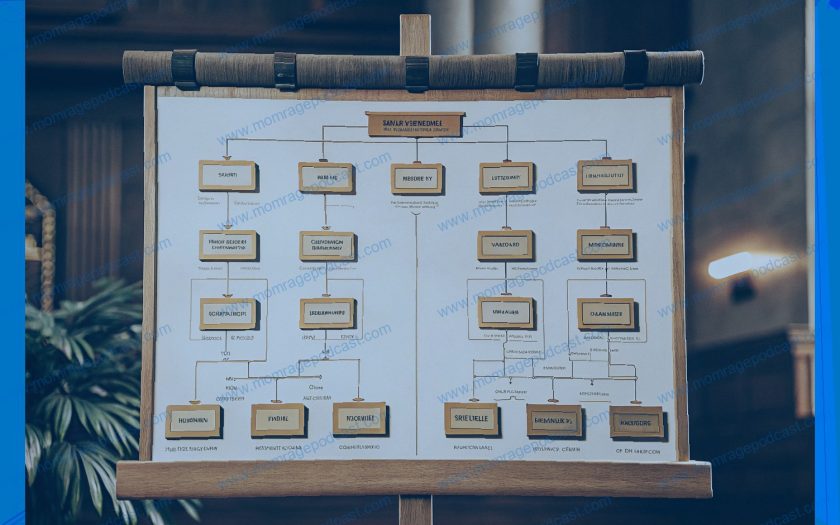

What is a Legal Entity Org Chart

A legal entity org chart is one that provides a visual representation of a parent and kid entity or entities and the relationships therebetween. These relationships are key to legal, business and tax issues involving these entities. The chart provides a quick snapshot of the hierarchies among entities including which entity has ownership or can influence or control decision-making relative to the other entities. In the context of a corporate structure, a legal entity org chart typically contains information pertaining to the names of the entities, dates of incorporation, state of incorporation and shareholder percentages if applicable. It may also contain information about officers (i.e., executive title and expiration of term , if applicable) and directors. It may track changes, if applicable, and identify ripple effect for successors-in-interest. The purpose of the legal entity org chart is to provide a snapshot that may later be attached to a certificate of good standing or an order authorizing reinstatement. This snapshot comes in handy in conjunction with due diligence in purchasing the assets or stock of a target company/entity. For purpose of a tax opinion, if a legal entity org chart is provided with entity statuses, it will indicate whether each entity is a (non) taxable (disregarded) entity for tax purposes. A chart with this information can clarify the parent and subsidiary relationships and provide the IRS a picture of organizational structure in a single document.

Components of a Legal Entity Org Chart

The main elements of a legal entity org chart include subsidiaries, affiliates, divisions, and parent companies:

Subsidiary – A subsidiary is a company controlled by another company. Its shareholding of the ownership interest can be majority (i.e., greater than 50%) or minority (i.e., less than 50%). Generally, the shares in a subsidiary can be owned by its parent company or by another entity, but are in any case separate from its parent company.

Affiliated Companies – Affiliated companies are companies that have a parent-subsidiary relationship. It is important to note that companies that are affiliated with each other may or may not be under common or controlling ownership. Essentially, an affiliated company is a company under the authority or control of another company. However, control does not necessarily mean 50 percent ownership, as it can be exercised through a direct or indirect controlling interest in securities or otherwise.

Divisions – A division of a company is a self-governing business unit that is not a separate legal entity. If there was a planned separation, then the division name might be involved in the name of the new entity and the division would be given a period of time within which to create a separate legal presence in the new location. In contrast, an affiliate is the name of the new company that could be similar to the parent company name. In effect, a division is a company that is part of a larger corporation while an affiliate is a distinct legal entity that is either partially or wholly owned by the parent company, although the name of the affiliate may be similar to the parent company name.

Parent Company – Parent company is the controlling entity that owns the shares of one or more subsidiary companies.

Legal Entity Organizing Charts Advantages

Multinational companies increasingly recognize the power of legal entity org charts to enhance visibility and clarity in decision-making and regulatory compliance. The following are just a few examples of how legal entity org charts help to illustrate complex legal and business relationships among companies and their stakeholders.

"The scope of a multinational’s business is a very complex topic that management of a multi-jurisdictional organization tries to portray on a non-legal "tree chart." However, the legal aspects of the structure are quite relevant to understanding the true business implications of separation or combination transactions." 3i Group plc

"An organizational chart is a deceptively simple tool that is utilized in every multi-national model, applicable from small to large tools. It will be an invaluable tool used as part of the due diligence for any acquisition process. With such a broad level of detail captured, it allows for easy understanding from a valuation and integration perspective." Meredian, Inc.

"There will be huge advantages for both the tax authorities and the taxpayers in being able to visualize complex structures." Ernst & Young

"Legal entity information is critical for a broad range of business reasons, including consolidation and group reporting; corporate governance; tracking foreign ownership; due diligence; contract negotiations and management; tax compliance and planning; country risk assessments; and national security." Institute of Chartered Secretaries and Administrators

"Visualizing your entire organization is essential as it allows you to focus on opportunities as well as risk. With a legal entity org chart, patterns emerge, making it easier to surface issues and opportunities that are otherwise difficult or impossible to locate." Altus Global Trade Solutions

How to Build a Legal Entity Org Chart

A legal entity org chart is only as good as the process that is used to create it. A poor process usually creates a poor result. A few simple steps can keep an organization from becoming overwhelmed and making mistakes, or worse yet, becoming so frustrated that it abandons the project of getting its legal entity information into one place, at one time, in a consistent format.

The first step in creating a legal entity org chart is collecting necessary information. Some of the information will be collected by hand, but there are several ways to streamline the process. Much of the information about the legal entities themselves can be obtained through online searches of databases within companies’ home countries. The remaining information often can be obtained from the organizational documents of the entities. If the company has formal records management protocols in place, this makes the collection process relatively painless. If not, locating the documents may be a challenging multiyear scavenger hunt.

Like many things in life, you can spend anywhere from a little to a lot collecting the information you need to create your chart. However, the costs of spending less than you "should" can come back to haunt you later. The old adage "98% of a project takes 2% of the time," which reflects the difficulty of setting things in order, applies here. When you commence the process of gathering the information necessary to create a chart, what may be needed quickly expands to include information that you would like to have but that is not actually necessary. You soon find yourself spending time trying to locate, for example, the exact dates that an ownership interest changed hands, which document you actually want to use (more on that below), and the complete financial records. The chart that started as a good idea and cost you a couple of dozen hours to complete is now a drain on your resources, taking up you and others’ time and effort.

From a practical standpoint, you should collect as much information as you can gather in one place and in one file format. This will save time when you come across the next entity and can search for its information next "door," instead of "on the other side of the country." Organize its location in the file system in a way that makes sense to you and your organizational structure. This way, if and when it makes sense to add new information about old entities, you will know where to look and what you already have. Limiting your collection to a reasonable subset of information will help you see the benefit of the completed project.

After the documents are collected and organized, it is time to prepare your org chart. The choice of which software to use to create the chart can be overwhelming. Like the collection process, there are several possibilities, ranging from do-it-all spreadsheet to free online tools. Like most other things in life, the tools you choose are a matter of context. For example, if you know that you will only ever use the chart in-house, tracking changes and disseminating the chart via Excel or PowerPoint may be fine. If you are going to present the chart to external stakeholders, you may want to invest in chart creation software and choose to spend the extra time it takes to build a chart that looks exactly the way you want it to.

Even with a great tool in hand, there are some best practices for creating a legal entity org chart. If you are trying to make your chart reader-friendly, here are a few simple tips:

An attractive legal entity org chart translates into an attractive company. Conversely, a legal entity org chart that is a mess communicates "disarray" to the people that matter. Those "people that matter" include prospective or existing investors, prospective or current employees, vendors, customers, and regulators, among others. Each of these groups may rely on the org chart making it either harder or easier for your organization when you are seeking investment or attempting to enter into joint ventures, acquisitions, and other potentially beneficial contracts. With this in mind, the painstaking effort spent on creating a legal entity org chart will pay dividends.

Legal Entity Org Chart Challenges and How to Address Them

The more complex the organization, the more complex the legal structure, and vice versa. When it comes to a global legal entity org chart, there simply isn’t a shortcut. You need to have an accurate, timely, granular global legal entity org chart in order to be able to provide useful insights and information. For a large, global business, that’s not always going to be a simple task. This section addresses some of the most common challenges businesses face when developing and maintaining a legal entity org chart, and strategies for overcoming these issues.

Data Inaccuracies

Inaccuracies relating to entities on your org chart can come from (a) a lack of clarity as to which business entity is registered in which jurisdiction, (b) missing information about registered entity data, or (c) failure to capture recent changes in ownership or other material changes. Dealing with Missing or Inaccurate Information. One way to prevent inaccuracies, for example those arising from a lack of clarity as to which entity is owned by which entity, is to ensure that an individual or individuals with responsibility for each subsidiary are assigned as "owners" of specific entities. These individuals would be expected to maintain accurate information for an entity for which they bear responsibility. In the absence of accurate or current information , you need to ensure that you develop the ability to communicate quickly and accurately with your subsidiaries. One means of capturing information in a more automated form (for a fee) is to use an entity management system. A less expensive means of communicating with subsidiaries and capturing information about changes to the legal entity structure in a timely manner is by using a self-reporting questionnaire. This may involve soliciting responses from local counsel regarding what is meant by "control" and "legal powers" and help the questionnaire be focused on what actually drives the legal entity structure. Inconsistent Update Practices. It is also important that a consistent practice be developed to update information about legal entities on a regular basis to avoid relying on outdated information. A monthly check, quarterly check or even checking annually on changes may be helpful, depending on the size of the organization.

Consolidating Complex Structures

As mentioned earlier, the complexity of the org chart can result in a complex structure with multiple layers, and that needs to be consolidated into only one org chart. Gaining access to all business units for the consolidation process required building a mutually trusting relationship with each individual location or complex business unit representative. This was achieved by demonstrating and making them believe that having a clean legal entity structure was beneficial to them when needed by the global headquarter.

Legal Entity Org Chart Compliance Issues

Legal and compliance considerations come into focus with virtually every element of a legal entity org chart. When a state’s laws change, or an internal policy is updated, the legal entity change management task can be daunting. Whereas a singular change to a business record may be relatively easy to amend, the legal ramifications of failing to make an necessary update often warrant a full review of the entire organizational structure.

Legislatively required filings are a matter of record, and there is abundant information state by state and jurisdiction by jurisdiction on which documents are required and which deadlines should be tracked. The challenge is whether your legal entity management process has this information tracked, reviewed, and updated within the prescribed period.

Informally required filings can be more complex. Take, for example, listing company officers on a website, vetting and approving potential company directors, or other board member oversight. These are all common requirements, to some extent, for public companies. Yet, privately held companies are barely subject to officer or director disclosure requirements. This may seem like an understatement if you are working for a company that is subject to Sarbanes Oxley, New York Banking Law, or SEC disclosure requirements. However, these requirements can be a burden on closely-held companies, particularly those in regulated industries.

This is not to say that privately held companies should ignore these issues. To the contrary, at the very least, closely held companies should determine which of their policies and procedures place them in a position where compliance could potentially impact business strategy. In some instances, failure to adhere to something that seems inconsequential can result in some fairly serious consequences.

Consider a new employee who is placed on a record as a company "officer" before the requisite forms are completed. Here it may be that a requirement for shareholder approval for compensation, a potential liability limitation, or other rights is triggered. While the company likely does not want to avoid a shareholder approval requirement, it seems unlikely that it would want to accidentally confer a benefit (e.g., a stock option) that requires a shareholder vote of approval.

In the audit context, outside counsel will be asked to perform any number of tasks over the course of a year. Understanding which change management processes often trigger a review of an organization, and which do not is critical. For example, many clients will be subject to the annual "benign error" disclosure requirement under Sarbanes Oxley. This is a disclosure requirement associated with the inadvertent omission of information from an issuer’s periodic filing. There isn’t a blanket exception for "benign errors" to those requirements that trigger policies, such as a change in control provisions, so know your rules.

Legal Entity Org Charts Best Practices

The following are some examples of the use of legal entity organizational charts in the real world:

A foreign entrepreneur contacted us wanting to know if an entity should be formed in the US to start a new chain of natural health food stores in Tennessee. We had a pre-incorporation meeting, with some high level background research. When comparing state filing requirements, taxes, costs and overall business climate, we determined a recommendation was in order for a non-profit entity. The entrepreneur realized that starting a new chain of venture capital backed health food stores was going to be too capital intensive to be able to take off.

A clear visual such as a business structure org chart is a useful tool for the CEO of a company to present a new structure to his or her Board of Directors. Referring to the chart, it is easy to determine the structure of the current operating departments, departments being eliminated, and new departments being added. The CEO can show how the new structure will increase overall efficiency, understanding that this is the bottom line goal . From the previous example, with a clear visual depiction of the structure, the Board can visualize the way the new business unit will be positioned.

More and more companies are using org charts to depict complex fields such as license agreements. By using one clear, compelling visual to represent a strategy or organization, clients have a simple method to tell their story. A global oil and gas company uses a business structure org chart to indicate who owns what.

A company manufacturing cool Firefighting vehicles uses a visual like a legal entity org chart to show how it should be constituted. The company is in the process of divesting several product lines to focus on its core business. A business structure org chart is useful when communicating with investors, especially when a company has several business units (which may have cost each of their own). Having a clear visual could help the investor understand the company’s business.

It is advisable to rely on a legal entity org chart when trying to explain the corporate structure of a multi-company consolidated tax return. A legal entity org chart would be used to show the structure of the subsidiaries in relation to each other and the parent company.