When you’re waiting for a settlement check, the process can feel like an eternity. Whether you’ve been in an accident, are waiting for a legal settlement, or are simply trying to understand the financial aspect, knowing how long it takes to get a settlement check can help you plan accordingly. Let’s dive into the key factors that influence the timeline, the different stages involved, and what you can do to potentially speed up the process.

What is a Settlement Check?

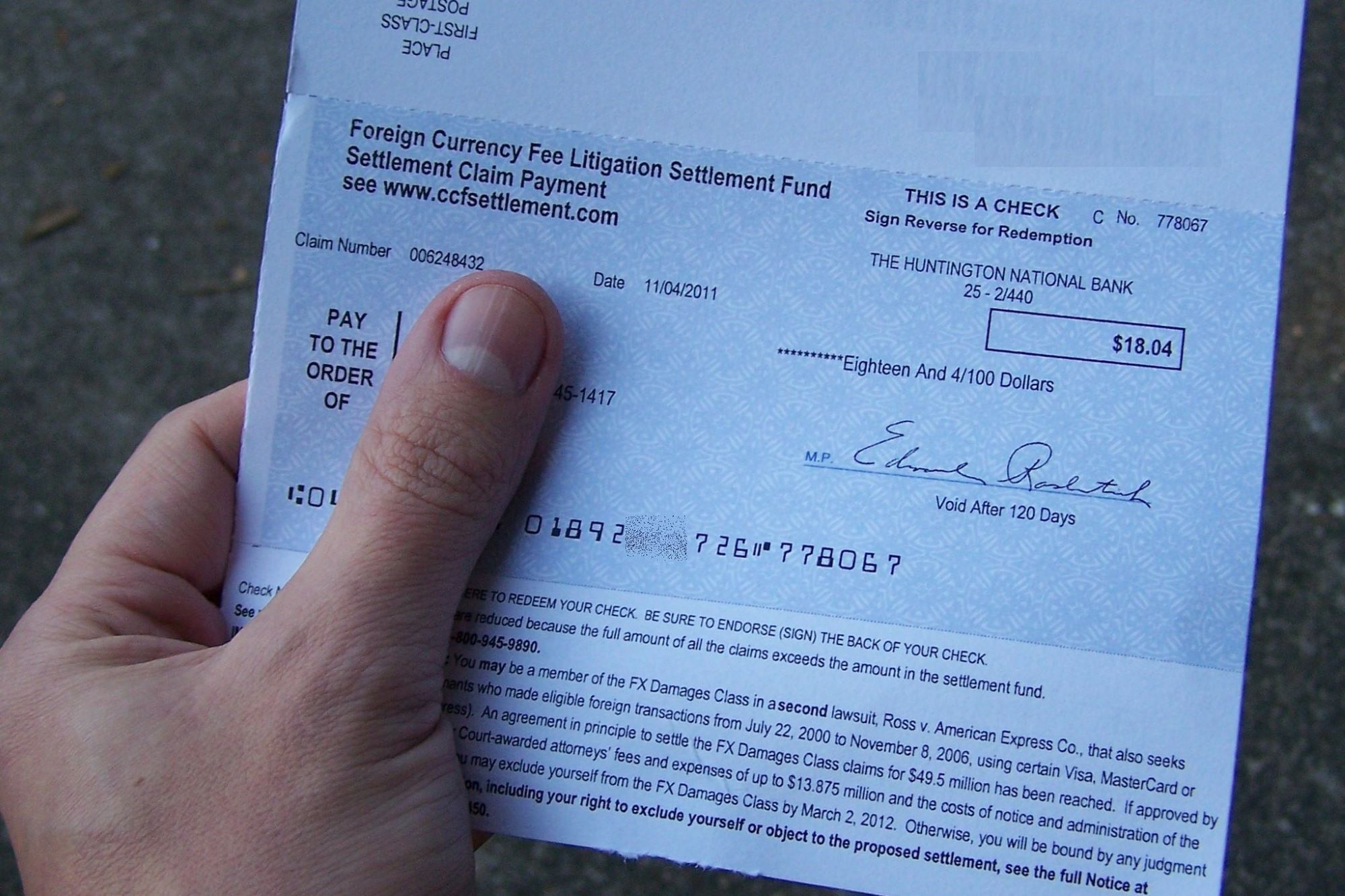

A settlement check is a payment issued to a plaintiff after the conclusion of a legal case, either through a court judgment or a settlement agreement. This check is designed to provide financial compensation for damages and losses incurred during the legal dispute. Common expenses covered by a settlement check include medical bills, lost wages, pain and suffering, and other related costs. The timeframe for receiving this check can differ significantly based on various factors, such as the complexity of the case, the processing procedures of the insurance company, and the overall legal procedures involved.

Factors Influencing the Time to Receive a Settlement Check

| Factor | Description | Impact on Timeline |

| Type of Case | Different types of cases, such as personal injury or property damage, have varying settlement timelines. | Personal injury cases often take longer due to their complexity compared to simpler property damage cases. |

| Insurance Company Delays | The efficiency and backlog of the insurance company can affect how quickly a settlement is processed. | Delays in processing by the insurance company can extend the time it takes to receive the check. |

| Court Approval | Some settlements require approval from the court before the check is issued. | Court approval can add several weeks or even months to the timeline, depending on the court’s schedule. |

| Lien Negotiations | Settlements may be delayed if there are liens, such as unpaid medical bills, that need to be resolved. | Negotiating and paying off liens before the check can be released can cause additional delays. |

| Payment Processing Time | The actual time it takes for the payment to be processed and mailed after all negotiations are complete. | The processing and mailing time can vary between different institutions, affecting when you receive the check. |

Stages of the Settlement Process

1. Case Settlement Negotiations

- Negotiation Phase: After a claim is filed, both parties (plaintiff and defendant) enter into negotiations. This process can take anywhere from a few weeks to several months, depending on the complexity of the case and the willingness of both parties to settle.

- Settlement Agreement: Once both parties agree, a settlement agreement is signed. The timeframe for this stage can range from a few days to several weeks.

2. Approval of Settlement Terms

- Review by Legal Counsel: Once the settlement is agreed upon, it must be reviewed by legal counsel. The review can take a few days to a few weeks, depending on the backlog and complexity of the terms.

- Court Approval (if required): For certain cases, especially those involving minors or incapacitated individuals, court approval is necessary. This can add additional time to the process, often taking several weeks or months.

3. Release of Claims Document

- Preparation and Signing: The release of claims document is prepared, stating that the plaintiff agrees to waive any further legal claims related to the case. This document must be signed by all parties involved. The preparation and signing usually take about 1 to 3 weeks.

- Verification and Finalization: After the document is signed, it is sent back to the insurance company or defendant for verification, which can take another 1 to 2 weeks.

4. Payment Processing and Check Issuance

- Processing Payment: Once all documents are finalized, the insurance company or defendant processes the payment. This typically takes about 2 to 4 weeks.

- Issuance and Mailing of Check: The check is issued and mailed to the plaintiff’s attorney, who then disburses it to the plaintiff after deducting legal fees and other expenses. This stage can take anywhere from a few days to a couple of weeks, depending on the method of mailing and processing.

Typical Timeframes for Settlement Check Processing

| Stage | Minimum Time | Maximum Time | Average Time |

| Negotiation and Settlement | 1 week | 6 months | 1-3 months |

| Approval of Settlement Terms | 1 week | 3 months | 2-4 weeks |

| Signing Release of Claims | 1 week | 4 weeks | 2-3 weeks |

| Payment Processing and Check Issuance | 2 weeks | 8 weeks | 3-5 weeks |

Common Delays in Receiving a Settlement Check

- Lien Negotiations: Negotiating and settling liens, such as medical bills or other debts, can delay the process.

- Administrative Errors: Mistakes in paperwork, such as incorrect details in the release form, can add extra time.

- Insurance Company Delays: The insurance company may have internal delays or backlogs, affecting the payment timeline.

- Court Approval Process: For cases that require judicial approval, any delays in the court’s schedule can slow down the process.

How to Speed Up the Settlement Process

Submit All Required Documents Promptly

To expedite the settlement process, ensure that all necessary paperwork is completed accurately and submitted without delay. This includes forms related to the settlement agreement, any required evidence, and supporting documentation. Prompt submission helps prevent hold-ups that can occur if documents are missing or incorrect. Ensuring that everything is in order from the start minimizes the risk of delays caused by incomplete or erroneous paperwork.

Stay in Regular Contact with Your Attorney

Maintaining regular communication with your attorney is crucial for speeding up the settlement process. By staying in touch, you can receive timely updates on the progress of your case and address any issues that may arise. Your attorney can also provide guidance on any additional steps you need to take and ensure that any obstacles are handled promptly. Regular contact helps keep the process on track and can expedite resolution.

Clear Any Liens Early

If there are potential liens, such as medical bills or other debts that might impact your settlement, address them as early as possible. Working to clear these liens beforehand can help avoid complications and delays in receiving your settlement funds. Early resolution of any outstanding debts ensures that they do not become a bottleneck in the settlement process, facilitating a quicker release of your settlement amount.

Negotiate with the Insurance Company

Be proactive in negotiating with the insurance company to accelerate the settlement process. Effective negotiation can help reach a quicker agreement and avoid prolonged discussions that can delay payment. Clear and direct communication with the insurance company about your expectations and needs can lead to a faster settlement, as well as potentially more favorable terms.

Use Electronic Payment Methods

Requesting electronic transfer of funds can significantly speed up the receipt of your settlement payment compared to waiting for a paper check. Electronic payments are typically processed faster and are more reliable. By opting for electronic methods, you reduce the time it takes for the funds to be transferred to your account, expediting the overall settlement process.

Role of Attorneys in the Settlement Process

Negotiation Assistance

Attorneys play a crucial role in negotiating on behalf of their clients to secure the best possible settlement. They use their expertise to advocate for favorable terms and work towards a resolution that meets their client’s needs. Skilled negotiation can lead to a more advantageous settlement and help resolve the case more efficiently, benefiting from the attorney’s experience in handling similar cases.

Documentation Handling

Attorneys are responsible for ensuring that all documentation related to the settlement is accurately completed and submitted. They handle the preparation, review, and filing of necessary documents to ensure compliance with legal requirements. Proper documentation is essential for avoiding delays and complications, and attorneys’ attention to detail helps maintain the integrity of the settlement process.

Communication

Attorneys facilitate smooth communication between their clients and the insurance company or other parties involved in the settlement process. They act as intermediaries to convey important information, address any concerns, and keep all parties informed. Effective communication by the attorney helps prevent misunderstandings and ensures that the settlement process progresses without unnecessary delays.

Lien Management

Attorneys manage any liens against the settlement, including negotiating and paying off debts that may affect the release of funds. They work to resolve these financial obligations to facilitate a quicker and more efficient settlement process. By handling lien-related issues, attorneys help ensure that the settlement is processed and disbursed without being delayed by outstanding debts.

Impact of Court Involvement on Settlement Timelines

- Court Backlogs: Courts often have heavy caseloads, which can delay the approval of settlements.

- Mandatory Hearings: Some cases require mandatory hearings before a settlement is approved, which can add weeks or months to the timeline.

- Judicial Review: Certain cases require judicial review to ensure fairness, particularly if minors or legally incapacitated individuals are involved.

Understanding the Role of Insurance Companies

- Claims Processing Time: Insurance companies have their internal protocols and timelines for processing claims, which can impact the settlement time.

- Investigation Period: Insurers often conduct their investigations to verify claims, which can delay settlement.

- Financial Solvency: An insurance company’s financial situation may also affect how quickly they can issue a payment.

Differences Between Personal Injury and Property Damage Settlements

- Personal Injury Settlements: Often take longer due to medical evaluations, lien negotiations, and the need for court approval in some cases.

- Property Damage Settlements: Typically faster as they often involve less negotiation and fewer legal complexities.

When to Expect the Settlement Check

- Simple Cases: In straightforward cases without liens or complex legal hurdles, a settlement check can be received in as little as 4 to 6 weeks after the settlement is reached.

- Moderate Cases: For cases with minor complications, such as a few medical liens, expect 2 to 3 months.

- Complex Cases: In complex cases involving significant medical treatment, multiple liens, or court approvals, the process can take 6 months or longer.

What to Do If the Settlement Check Is Delayed

Contact Your Attorney

If your settlement check is delayed, the first step is to contact your attorney. They can provide updates on the status of the check and might be able to expedite the process. Attorneys often have direct communication channels with insurance companies and other involved parties, which can help resolve issues more quickly. They can also offer guidance on the next steps to take and any potential legal actions that might be necessary to ensure you receive your funds promptly.

Check for Errors

Verify that all required documents have been accurately completed and submitted. Sometimes, delays occur due to errors or missing paperwork. Double-checking that all forms are correct and that no information has been overlooked can help eliminate potential issues. Ensuring that everything is in order can facilitate a smoother processing of your settlement check and help avoid further delays.

Request a Status Update from the Insurance Company

Inquire directly with the insurance company about the status of your settlement check. Insurance companies often have dedicated departments for handling settlements, and reaching out to them can provide you with up-to-date information. Requesting a status update helps you understand where the check is in the process and whether there are any additional steps needed to finalize the payment.

File a Motion with the Court

If the delay in receiving your settlement check is unreasonable and persistent, your attorney may need to file a motion with the court to compel payment. This legal action can prompt the court to intervene and order the responsible party to make the payment. Filing a motion is typically a last resort when other methods of resolving the issue have failed, and it can help ensure that you receive your settlement in a timely manner.

Tax Implications of a Settlement Check

Personal Injury Settlements

Personal injury settlements are generally not taxable if they are compensating for physical injuries or illnesses. These settlements are considered compensation for physical harm and thus typically fall under tax-exempt categories. However, it is important to keep detailed records of your settlement and consult with a tax professional to confirm the tax treatment based on your specific situation.

Punitive Damages

Punitive damages awarded in a settlement are usually taxable. These damages are intended to punish the defendant and deter similar behavior, rather than compensate the victim for losses. It is essential to consult with a tax professional to understand how punitive damages will be taxed and to ensure proper reporting on your tax return.

Emotional Distress

Settlements for emotional distress that are not tied to a physical injury may be taxable. Emotional distress settlements are treated differently for tax purposes, especially if they are not related to physical harm. To determine the tax implications of such a settlement, it’s advisable to seek guidance from a tax expert to understand how these amounts should be reported and taxed.

Interest Payments

Any interest accrued on your settlement amount is typically considered taxable income. This includes interest that accrues while you are waiting to receive your settlement check. Be sure to report this interest income on your tax return, and consult with a tax professional to ensure proper handling of any interest payments received.